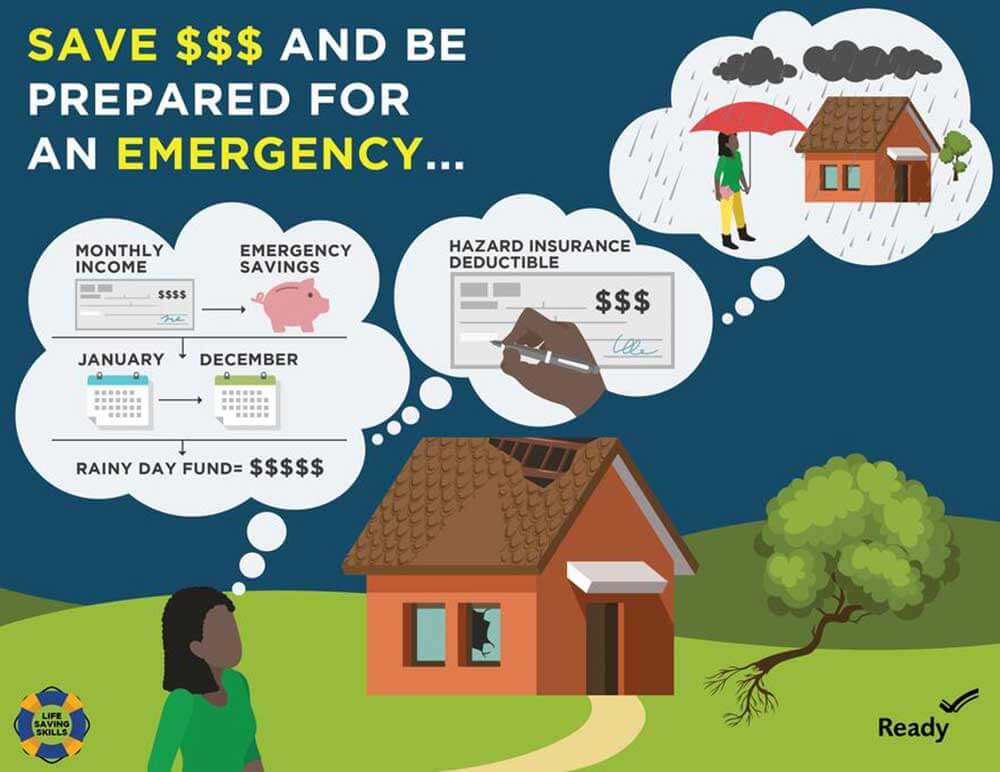

Americans at all income levels experience natural disasters like earthquakes, tornadoes, and hurricanes, but we also deal with flat tires, unexpected medical expenses, and accidents. If you create an emergency preparedness plan, you can calmly face life’s challenges head-on and sail through the storms. Consider the following methods to prepare for a rainy day.

Document and insure your property

Your home, personal belongings, and business are valuable assets. You should maintain a detailed inventory of your property’s contents to prove the value of your possessions and speed up the process for submitting and resolving claims. One easy way to start your inventory is to take photos or videos of your things and create a detailed description of the individual items, with information about the year, make, and model numbers if applicable. There are many smartphone apps available to help you create a digital inventory of your property.

Check your insurance coverage

If a disaster strikes, the best way to ensure you will have the necessary financial resources is to understand your insurance coverage. Your coverage can help you repair, rebuild, or replace whatever is damaged. Unfortunately, less than half of homeowners in the United States have adequate homeowners insurance to replace their home and its valuable contents.

Types of coverage on a homeowners insurance policy or *renters insurance policy

· Dwelling – coverage for your house

· Other Structure – coverage includes garages, decks, and fences

· Personal Property – coverage for furniture, clothing, and appliances

· Personal Property – coverage for furniture, clothing, and appliances

· Loss-of-Use – compensation if you need to relocate temporarily

· Personal Liability – coverage for accidents occurring on your property

· Medical Protection – payments for a person who is injured on your property

· Coverage to look for if you have renter’s insurance

Qualify for Discounts

You can ask your insurance professional about qualifying for discounts on the cost of your policy. Some insurers offer discounts if you install smoke detectors, burglar alarms, sprinklers, or other improvements designed to lessen potential risks. If you are a senior, have a membership in a professional group, or are a long-term policy holder, you may qualify for additional discounts. Check with your insurance professional to see if you can qualify for discounts.

Organize important information and stash some cash

Gather critical financial, personal, and medical documents in a safe location in your house. Some examples of these important documents include: photo ID, birth certificate, social security card, passport, tax statements, pay stubs, insurance policies, health insurance information, immunization records, prescriptions, and medications. Consider keeping a small amount of cash, including small bills, in a secure place because ATM’s and credit cards may not work during a disaster. You may also want to consider investing in a safe that is fire and waterproof to ensure this information isn’t destroyed in a disaster.