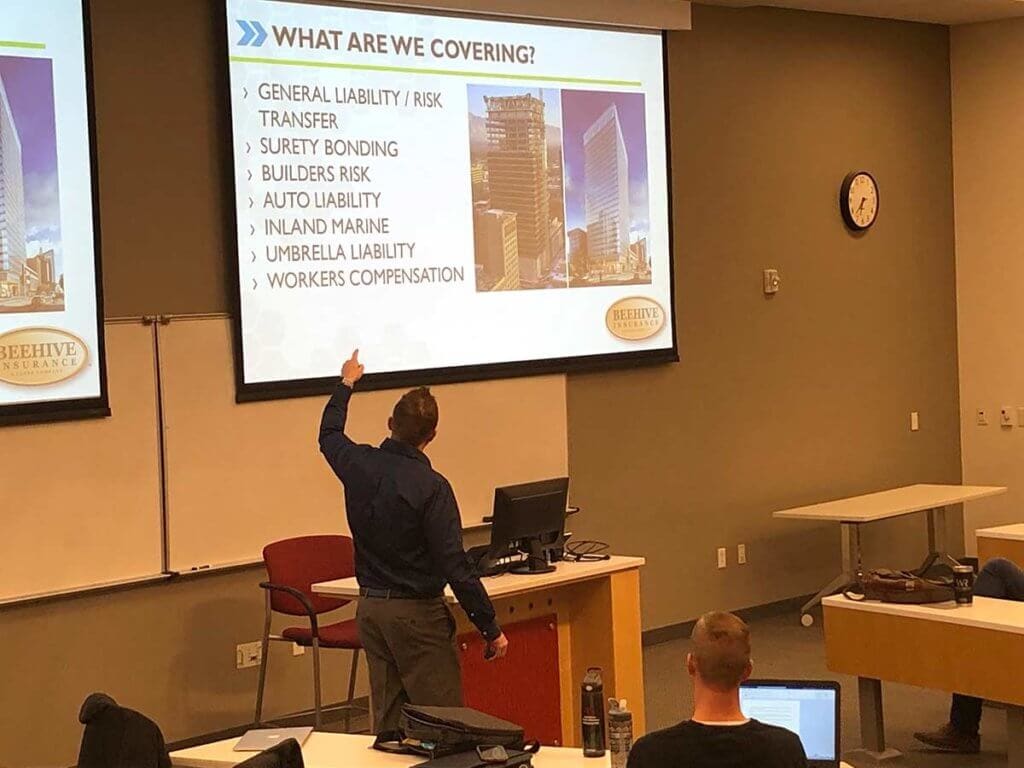

Brady Thorn, VP of Beehive Insurance, recently spoke as a guest lecturer at the University of Utah’s Master of Real Estate Development Course.

Brady explained the importance of proper risk transfer in the construction industry, especially today as projects and contracts are increasingly complex, and Beehive is a dominant player in the industry for providing insight and solutions to the challenges that developers face.

1. General Liability / Risk Transfer

2. Surety Bonding

3. Builders Risk

4. Auto Liability

5. Inland Marine

6. Umbrella Liability

7. Workers Compensation

Each individual policy type above is critical for a contractor and developer to understand. The days of “handshake deals” are over in the construction industry. This is because of the industry, the projects, the contracts are becoming more and more complex. The need for proper risk transfer is more critical than ever – whether contractually in a subcontract agreement or purchasing an insurance policy to transfer your risk to a third party.

Beehive is a dominant player in the industry for identifying and addressing these items with clients. We provide insight and guidance to the challenges that contractors and developers face each day. We are appointed and represent a wide variety of construction-focused carriers to help provide the solutions and coverages called for on a construction project.

In today’s environment, it is crucial for contractors and developers, who may not understand fully the risks, to be protected from exposures they may be taking. Developers need to sit down with a contractor-focused insurance broker like Beehive Insurance who understands these exposures, and more importantly, how to address them.

We can walk you through these details and make sure your proper coverages are in place and risk transfers are executed correctly. With this coverage in place, a company’s ability to move forward and on after a large loss is ensured. Remember, it’s not if a company will have a loss – it’s when. Let us help you be prepared and protected.